Have you wondered what the total market value of all of the world’s real estate is? Is such a number even ascertainable, and if so can you imagine what it is? This is exactly what Savills, an elite English real estate company, set out to accomplish and found they some interesting things.

In 2016, they estimate that total property value worldwide was $ 217 trillion. In the following year, 2017, this value rose to $ 228 trillion. That’s an increase of 5%.

The study also revealed a very interesting trend. Real estate is the most valuable asset in the world by far. Equities, bonds and precious metals are all way behind real estate in total market cap. For example, the value of all the gold that has ever been mined in the world, ever, is only $ 6.5 trillion!

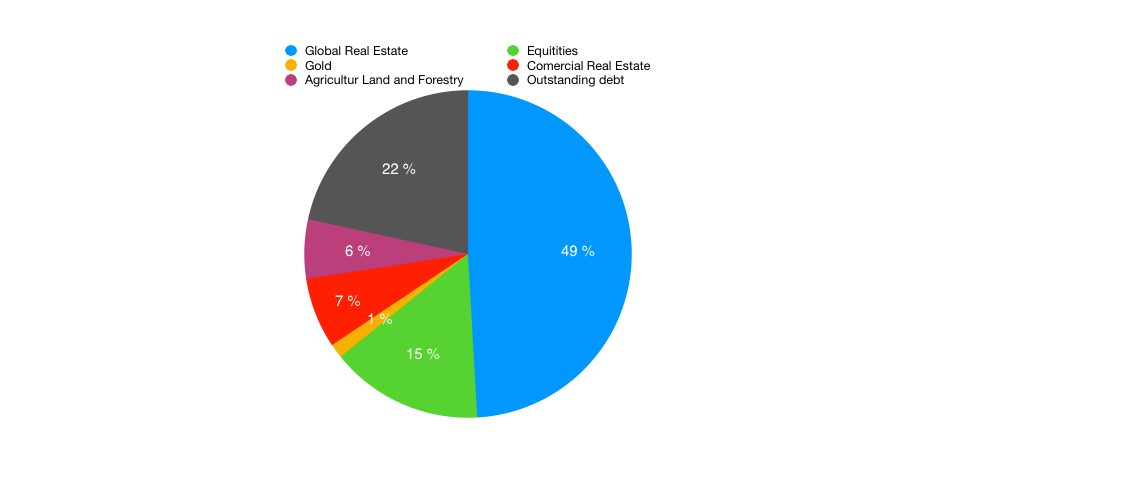

The diagram shows the value distribution of the world’s assets in 2017. Figures are in trillions of US dollars.

In this study, residential real estate is valued at $ 168.5 trillion. If you count the existing total of 2.05 billion households worldwide, that’s an average of $ 82,000 per residential property. Of course, this value is decisively influenced by the expensive industrialized countries like North America, Europe and parts of Asia.

Interesting facts;

- North Americans are just 7% of the world’s population, but they own 22% of the total value of residential real estate in the world.

- Europe’s inhabitants occupy 11% of the world’s population. But the home ownership is 23% of value worldwide.

- Of course, these values from industrialized countries also generate enormous potential in developing countries. For example, in Africa, 19% of the world’s population is living, but housing is only 6%.

It is estimated that 34% of all residential real estate worldwide invest in investments and make the housing market available. The rest is valued privately for private use. With commercial real estate it looks already different. Here, about 33% is self-employed and 67% go to the commercial sector. In this business sector, there was also the largest increase in real estate assets. Overall, this was 7 percent compared to the previous year and is nominally worth $ 32.3 trillion.

The real estate market worldwide expects such an investigation of immense importance. Not only that he is from year to year, that he also adds value. Also, with regard to the temporal interest costs, an investment in real estate becomes relatively alternative. The Styrian real estate prices and the ever increasing total populations make a property more and more interesting for investors.

We at Doctor Property are very curious how the numbers will evolve in the coming years. Of course we keep you up to date. Take another look at the blog of Doctor Property. We look forward to you.